Universal Basic Income (UBI) is frequently heralded as a cure-all for societal ills, particularly in light of job displacements predicted by some observers due to advancements in Artificial Intelligence (AI). Advocates argue that providing a regular cash payment to all individuals, regardless of income or wealth, could effectively alleviate poverty, enhance income security, and improve overall well-being. While the concept of a basic income is not new, recent cultural shifts and fears, driven in part by AI progress, have made UBI seem increasingly necessary.

Interestingly, the lockdowns implemented during the pandemic inadvertently became a mass experiment in basic income, as eligible individuals received government payments. This first-hand experience of receiving “free money” has made UBI a more feasible and appealing possibility. However, concerns persist around the funding of UBI and that unintended consequences it may bring, such as diminished personal responsibility and increased societal inequality. Moreover, when considering the government’s response to the health crisis, there is a worry that UBI could be misused as an authoritarian tool, especially if combined with a Central Bank Digital Currency (CBDC) that might further perpetuate a system of dependency and conformity.

Proponents of UBI hope to highlight its potential benefits as a think tank, known as Autonomy, plans to conduct a two-year pilot program in the North East of England and North London by providing £1,600 ($2,040) per month to 30 participants. Their goal is to gather evidence that supports the implementation of a nationwide basic income and conduct more comprehensive trials to fully comprehend its potential in the UK.

Autonomy’s Director of Research, Will Stronge, asserts that UBI has the power to reduce poverty and significantly enhance the well-being of countless individuals, making it too substantial an opportunity to ignore. In a similar vein, anthropologist David Graeber contends that the current prevalence of meaningless jobs in Western society has adverse effects on mental well-being. He adds that UBI could liberate individuals from the burden of engaging in these unfulfilling occupations solely for the sake of financial security. This liberation, in turn, may lead to a positive shift in attitudes towards oneself and others, as the struggle for survival diminishes. Furthermore, the Covid-19 lockdown period witnessed a surge in hobby adoption, with people having more freedom to choose how to spend their time. This period also witnessed a 13% increase in new business formations, suggesting that UBI could foster entrepreneurialism.

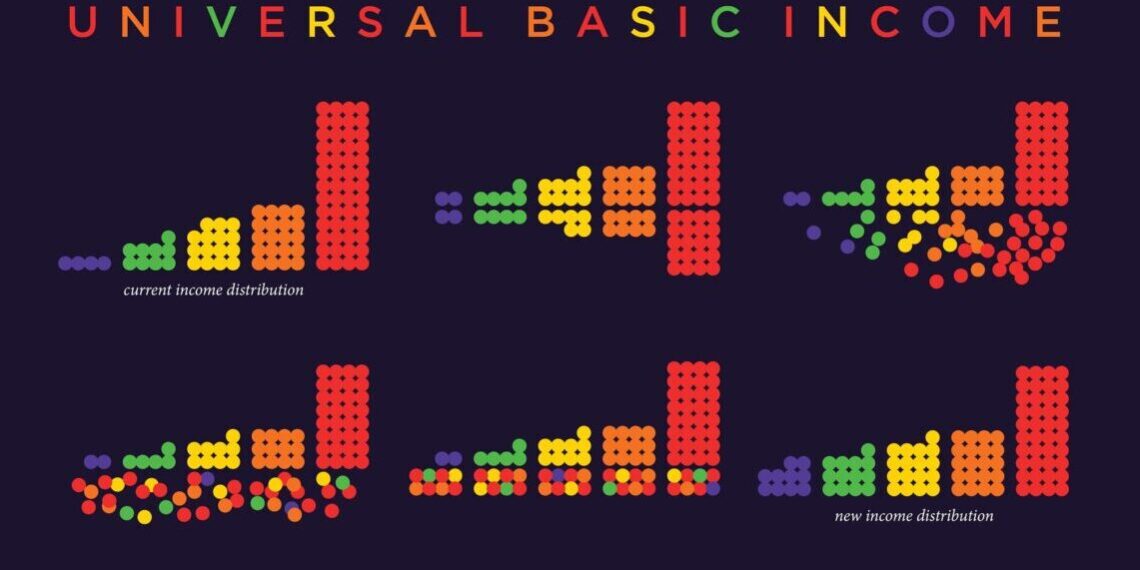

On the other hand, critics argue that UBI could exacerbate inequality rather than create a more egalitarian society. According to political and financial writer Stephen Bush, since UBI is provided to all individuals regardless of their circumstances, it may disproportionately benefit higher earners, allowing them to consolidate their advantages in various aspects such as property ownership and access to quality education. Despite the humanitarian appeal of guaranteeing a minimum monthly payment for all, questions arise regarding the feasibility of such a system due to its high costs. The Joseph Rowntree Foundation, although generally supportive of a basic income plan, cautions that UBI is not a “silver bullet,” as its implementation would require a radical restructuring of society and the economy. The issue of funding UBI has proven to be a sticking point, even among proponents, as tax increases may be necessary. Professor Matthew Johnson from Northumbria University conducted a study in the UK, revealing that around 70-80% of the population supports a basic income of £995 ($1,270) per month, substantially lower than Autonomy’s proposed amount. However, even at this lower rate, the estimated annual cost would amount to £480 billion ($612 billion), equivalent to 22% of the UK’s GDP.

Concerns also arise regarding the potential involvement of the government, especially when considering the development of CBDCs. Critics argue that the centralization of control in the hands of the authorities may lead to the manipulation of transactions, blocking specific purchases or even imposing expiration dates on those government regulated digital currencies to discourage saving. The government’s response to the health crisis has also revealed an inclination to overreach their powers, imposing strict lockdown measures and suppressing dissent. Consequently, public trust in government has dwindled to historic lows, highlighting the need for cautious scrutiny of the implementation of government digital currencies and UBI rather than blind acceptance. While UBI may appear to hold promise in addressing potential AI-driven poverty and inequality, it is essential to remain mindful that there may be unforeseen repercussions to manage.

The whytry.ai article you just read is a brief synopsis; the original article can be found here: Read the Full Article…